Paperless office

I finally did it. My aim of getting rid of all printed stuff on a day to day basis is complete. For ten years, I’ve amassed thousands of bits of A4 paper – bank & credit card statements, receipts for expenses, model & property releases, letters, contracts, and more. Even though you only need to retain six years of documentation to satisfy the wonderful machine known as HMRC, it builds up into a solid mass of stuff that takes over your home unless you hire somewhere to store it. When I had the studio, it wasn’t an issue – the paperwork was piled in plastic boxes, and every now and then I would dig something out to check it, or send to someone.

My accountancy system is quite simple, but effective. I used Sage Instant Accounts for years, which required me to have Windows installed on my Mac – via a bit of software called Parallels, which allows other operating systems to be run alongside the native OS. The beauty of a Mac is it’s relative simplicity, and I always hated having to spark up Windows just to do my accounts. I usually did it once a month, and I’d inevitably get the message that I had 37 important Windows updates to download. God almighty. At the beginning of September, I took the plunge, and bought into the Sage One system – a subscription based accountancy package which runs on a browser. No more Windows!

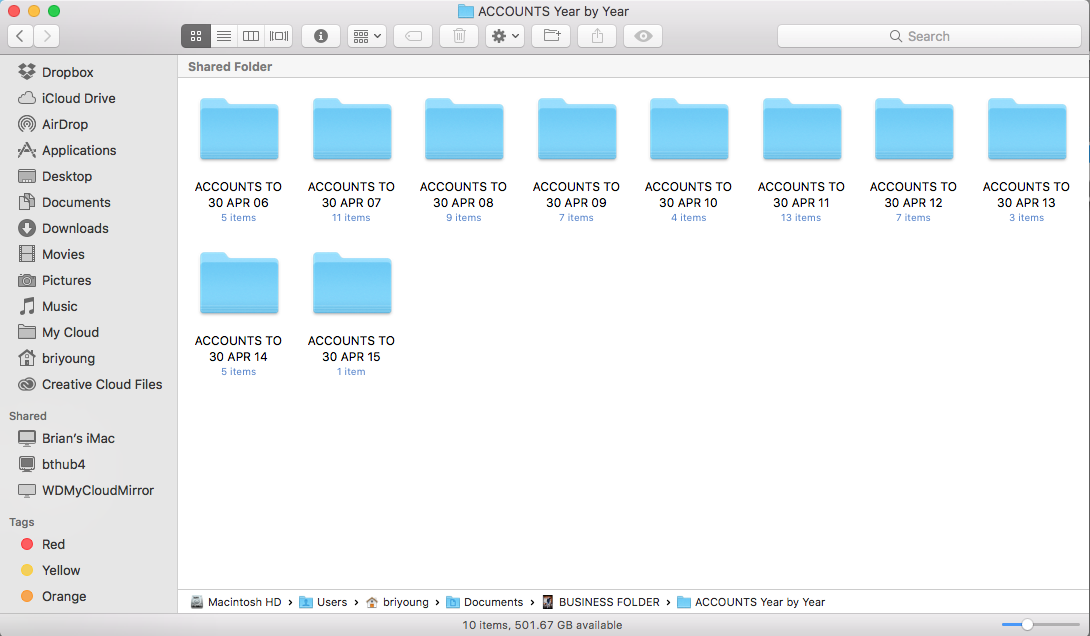

Everything that goes through your business obviously has to be recorded, accounted for, and retained for six years. (unless you’re a hairdresser, grass cutter, window cleaner, plumber etc, – in which case you get to keep everything you earn in hard cash, so don’t need any documentation except the bare minimum, fleece the hell out of the likes of me, but still use all the public services that are paid for by tax receipts such as hospitals, schools etc). Anyway, it’s perfectly acceptable to maintain records as image files as long as they’re legible and accessible. My financial year begins on the 1st May each year, and I denote the period with the prefix FY, and the year in which the period ends – the current one is FY17.

There are four accounts to cater for – a business current account, used for all the day to day stuff, a deposit account, where I transfer VAT before it needs to be paid, a company credit card for bits and pieces of expenditure when times are tight, and the Petty Cash float – for smaller items paid in cash like parking etc. Whenever I pay for something, the receipt is photographed on my iPhone using a free app called Office Lens. The image is cropped automatically, and stored in my iCloud photo library until needed.

Every few days I give the receipts a unique reference number, and put them in a backed-up folder on my work iMac. The payments from my current account are named sequentially as FY17-001, FY17-002 etc. the same reference numbers are applied to the corresponding transactions in the Sage software. The same thing is done for the credit card transactions – FY17-CC001, FY17-CC002 etc. Finally the petty cash receipts over £5 are numbered FY17-PC001 and so on. This means I have an online bank statement, and pdf’s of the receipts, all with matching reference numbers that can be audited at any time. No paper involved, as the receipts are put in the recycling bin once photographed.

Sage One creates detailed vat invoices which are emailed directly to clients. A quick follow-up via email to confirm receipt is done afterwards. Again, no paper involved.

Insurance renewals, professional memberships, client correspondence, and all that stuff is also done via email, and stored in the cloud. Some people worry that the cloud isn’t secure, and that data can be corrupted. I honestly couldn’t care less. if some Chinese hacker wants to download my car insurance policy, or see that I chased up a client for £96, then go ahead Chin-Wah. Wipe it clean for all I care.

So I got rid of paper invoices, bank statements, receipts, credit notes, property releases, and all correspondence for the current financial period. I still had six previous years of paperwork which needed to be photographed and catalogued consistently, so I processed one full year every week, and shot everything with my Fuji X-E2 and a dual-flash setup. In a short time, my mountain of documents was reduced to a few hundred Megabytes.

Now…. what to do with a 1.5 metre pile of paper? I did what ant sensible business person would do – put it in two massive rubble-buckets, filled them with water, left it to soak for a few days, and let the kids turn it into a hundred kilos of paper mache. Unfortunately, I left it a bit too long, and it turned into a mass of mush that smelled like vomit. I dragged the buckets to the farm tip out back, and dumped it all there. It went up in smoke during the monthly farm-fire.

This isn’t the first digitisation project I’ve undertaken. My entire CD collection was ripped to hard drive, before being given to a charity shop. Pretty much all my books were sold on Amazon, and I now purchase ebooks if required. Obviously my work-based photos are digital, but I’ve also scanned all my old negatives. Everything is stored on two separate Macs, and backed up on two remote hard-drive disks, and a network attached storage drive.

Simplify your life, get with the 21st century, and ditch the paper!